Social Security Remains Crucial Income Source for Majority of Retirees

Recent data reveals that an increasing number of retirees depend heavily on Social Security benefits to support their financial needs. According to the latest Gallup annual survey, 62% of retirees identify Social Security as a major income source, marking a rise from 60% in the previous year. Additionally, 24% of retirees consider their monthly Social Security payments a minor but meaningful part of their retirement income.

Impact of Cost-of-Living Adjustments on Retiree Budgets

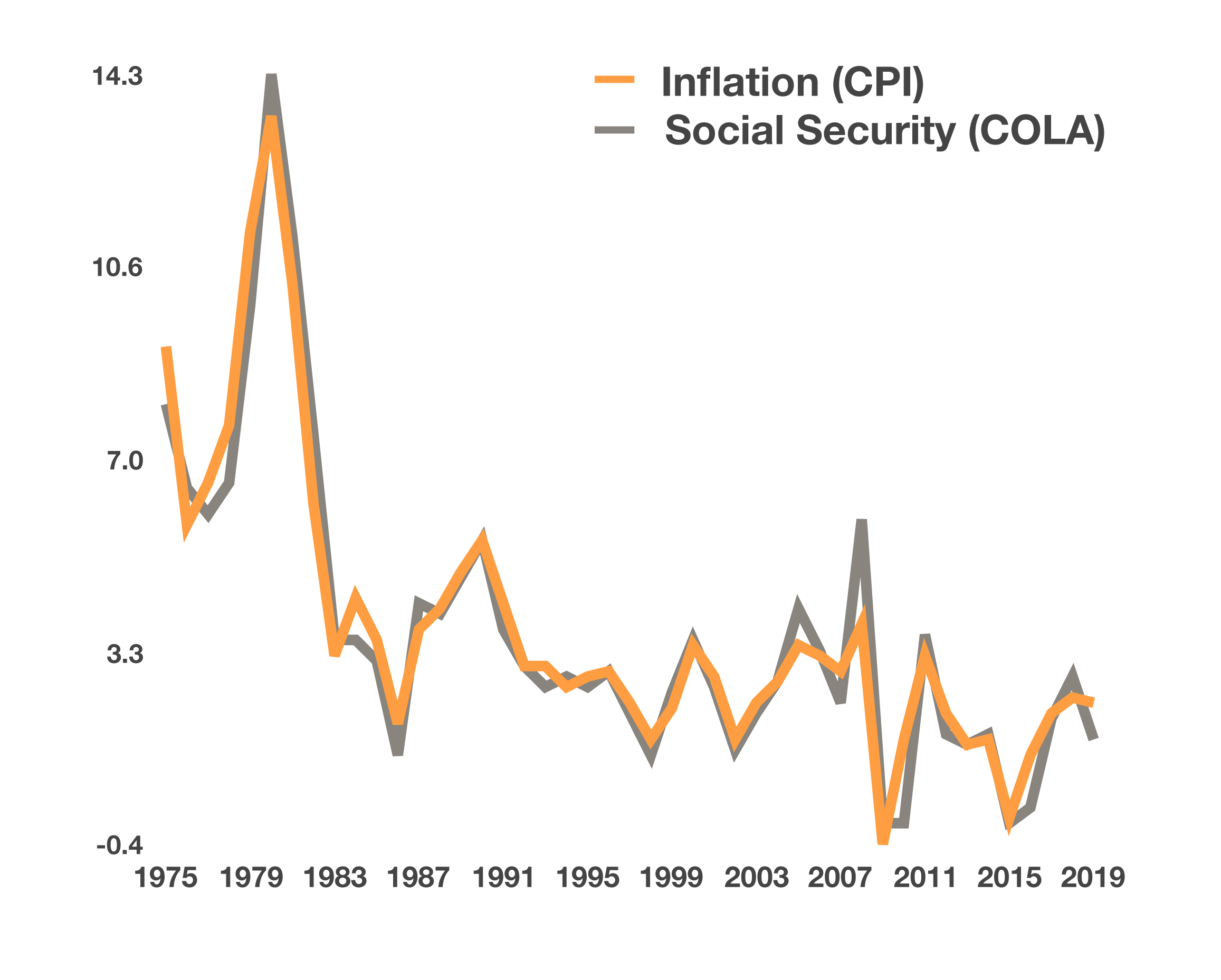

For retirees who rely on Social Security as a key component of their financial planning, the annual cost-of-living adjustment (COLA) plays a critical role in shaping their spending capacity. The COLA is intended to offset inflation by increasing Social Security payments in line with rising prices for goods and services. However, many seniors have faced financial challenges recently as inflation has driven up costs across nearly all categories.

Although the official COLA for 2026 will not be announced for another two months, retirees have already received the initial data point that will influence next year’s adjustment. This early insight provides a glimpse into how much their benefits might increase.

How the Social Security Administration Calculates COLA

Understanding the methodology behind COLA is essential. The Social Security Administration (SSA) bases the adjustment on a specific inflation measure known as the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index is compiled monthly by the Bureau of Labor Statistics (BLS) through extensive price surveys conducted nationwide. It covers over 200 categories of goods and services, each weighted to reflect its importance in the overall index.

The SSA calculates the COLA by examining the CPI-W data from the third quarter of the year—July through September. The year-over-year percentage increase in the average CPI-W during these three months determines the COLA for the following year.

Current Data and What It Means for 2026 Benefits

On August 12, the BLS released the CPI figures for July, providing the first necessary data point for calculating the 2026 COLA. The August CPI data, expected on September 11, will further clarify the inflation trend and help finalize the adjustment amount.

As inflation continues to affect prices broadly, the upcoming COLA will be closely watched by retirees and policymakers alike. The adjustment not only influences individual budgets but also reflects broader economic conditions impacting millions of Americans relying on Social Security.

In summary, Social Security remains a vital income source for a growing share of retirees, with the annual COLA adjustment serving as a key factor in maintaining their purchasing power amid inflationary pressures. The forthcoming data releases will provide clearer indications of how benefits will change in 2026, shaping retirement finances for many.